alameda county property tax calculator

Use our property tax calculator to see how these taxes can affect your monthly mortgage payment. Kansas is ranked 25th of the 50 states for property taxes as a percentage of median income.

City Of Oakland Check Your Property Tax Special Assessment

Alameda County has one of the highest median property taxes in the United States and is ranked 68th of the 3143 counties in order of median property taxes.

. City level tax rates in this county apply to assessed value which is. Alameda County collects on average 068 of a propertys assessed fair market value as property tax. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in taxes per year.

In many cases we can compute a more personalized property tax estimate based on your propertys actual assessment valuations. The property tax rate in the county is 078. If youre a resident of Alameda County California and you own property your annual property tax bill is probably not your favorite piece of mail.

The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900. Situated on the eastern shore of the San Francisco Bay Alameda County contains the cities of Oakland Berkeley and Fremont among others. Johnson County collects the highest property tax in Kansas levying an average of 127 of median home value yearly in property taxes while Osborne County has.

This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our California property tax records tool to get more accurate estimates for an individual property. Where to find property taxes plus how to estimate property taxes. But remember that your property tax dollars pay for needed services like schools roads libraries and fire departments.

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. The average effective property tax rate in Alameda County is 078. Alameda County property tax.

Census Bureau American Community Survey 2006-2010. The median annual property tax payment in Santa Clara County is 6650. The exact property tax levied depends on the county in Kansas the property is located in.

Santa Clara County Ca Property Tax Calculator Smartasset

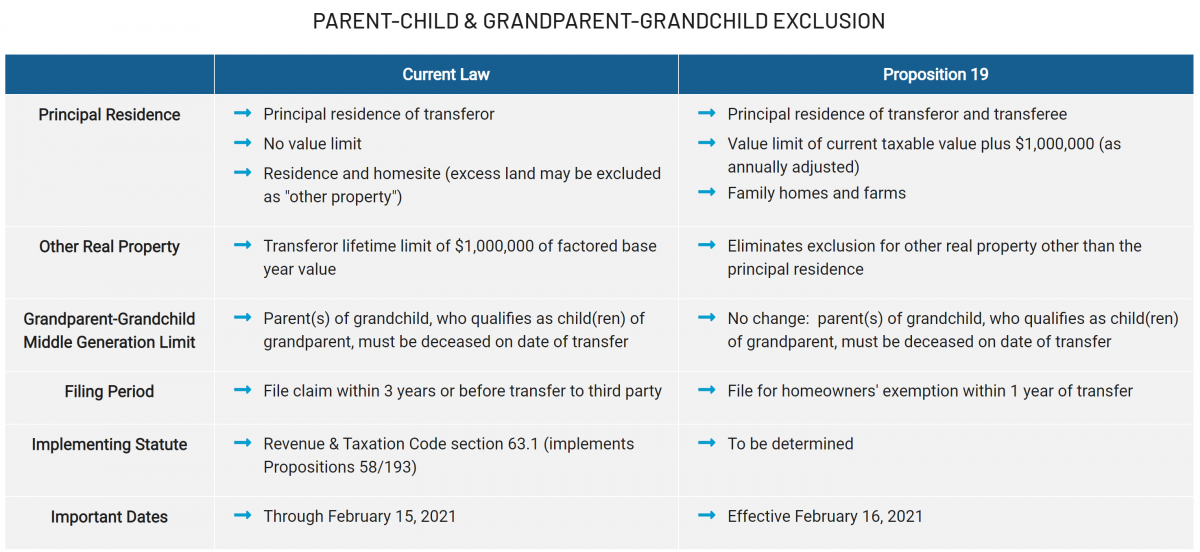

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Alameda County Ca Property Tax Calculator Smartasset

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Alameda County Ca Property Tax Calculator Smartasset

Alameda County Ca Property Tax Calculator Smartasset

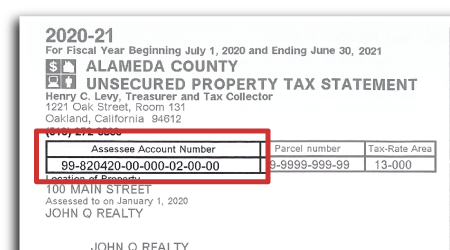

Search Unsecured Property Taxes

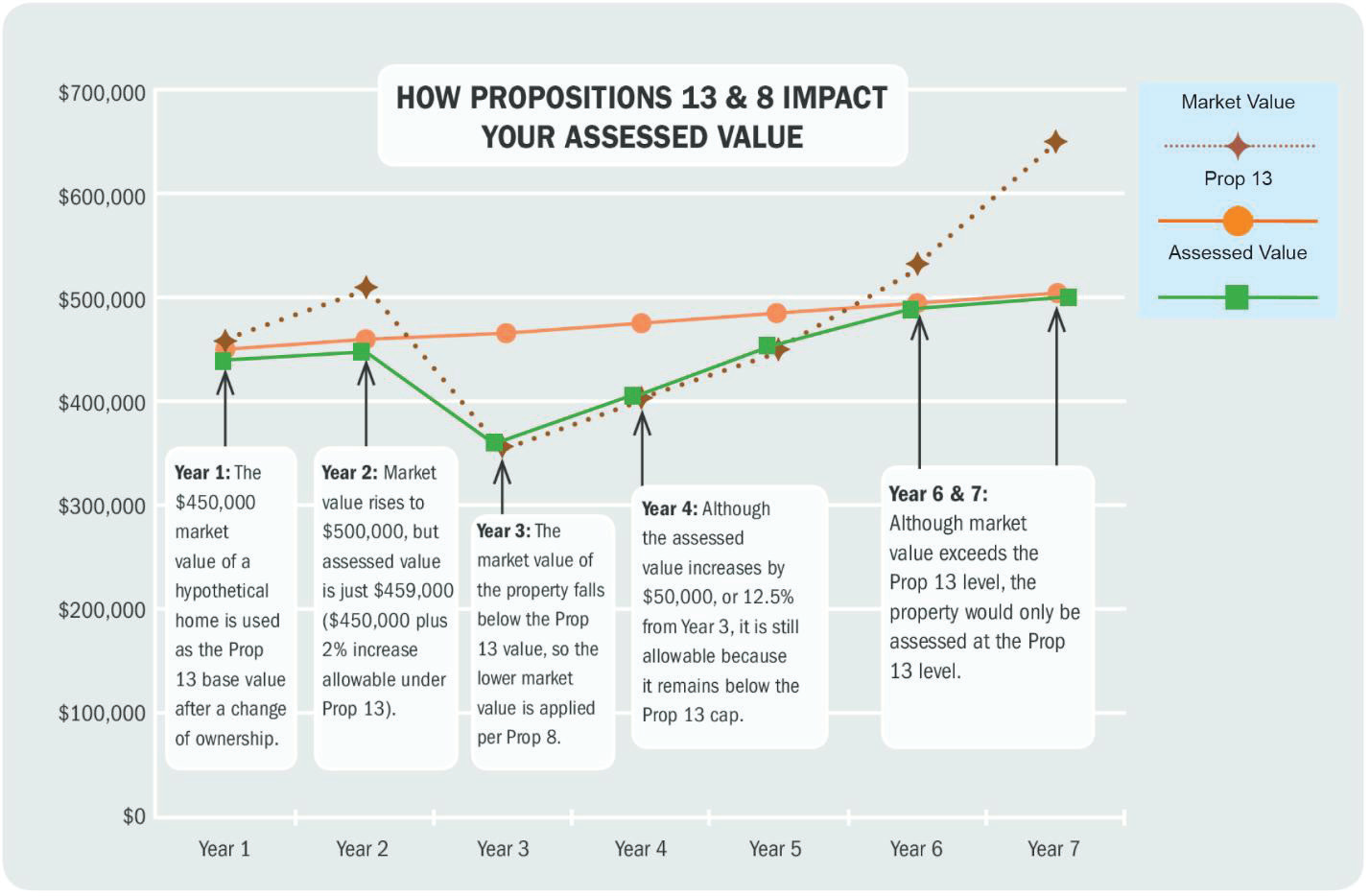

Understanding California S Property Taxes

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

677 Bluff Street Ne Hutchinson Mn 55350 Mls 5577891 Themlsonline Com Construction Loans Real Estate Home Mortgage

Rental Property Owner Management Kit Rental Owner Printable Etsy Real Estate Investing Rental Property Rental Property Management Rental Property Investment

Understanding California S Property Taxes

Decline In Market Value Alameda County Assessor

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Alameda County Ca Property Tax Search And Records Propertyshark

Pin On Articles On Politics Religion

How To Calculate Property Tax Everything You Need To Know New Venture Escrow